Family Business Buyouts in Divorce

Divorce can place extraordinary pressure on a family-owned business, turning questions of ownership and value into urgent, high-risk assessments. When spouses must determine whether one party will buy out the other’s interest, the process often shapes not only the financial outcome of the divorce but also the future of the business itself. Under Texas community property law, a family business may represent one of the most valuable assets in the marital estate, and an improperly handled buyout can create lasting financial exposure for both spouses. As such, family business buyouts in divorce demand a careful analysis of legal rights, financial realities, and long-term viability. If your divorce involves a family business, it is critical to speak to an attorney about how you can protect your interests. At McClure Law Group, our practiced Dallas divorce attorneys bring focused experience to high-stakes matters, and if you hire us, we will work towards a solution that is both equitable and sustainable.

Determining Whether a Family Business Buyout Is AppropriateIn many divorces involving a family business, courts and parties alike prefer a buyout over continued co-ownership. Ongoing joint ownership between divorced spouses is rarely practical, particularly when other family members are involved in management or ownership. A buyout allows one spouse, often the spouse actively involved in the business, to retain control, while compensating the other spouse for their community property interest.

Whether a buyout is appropriate depends on several factors, including the business's structure, cash flow, outstanding debt, and the spouse’s ability to finance the buyout without destabilizing operations. Courts will also consider whether the business is the primary source of income for one or both spouses. In Texas divorces, family business buyouts must align with the overarching requirement that the property division be just and right, taking into account the financial realities of both parties.

Valuation of the Family BusinessAccurate valuation is central to any family business buyout in divorce. Unlike publicly traded companies, family businesses often lack readily ascertainable market values, and their worth may be tied closely to the continued involvement of a particular spouse or family member. Texas courts frequently rely on qualified financial experts to determine value, taking into account assets, liabilities, income history, goodwill, and future earning potential.

Disputes often arise over the appropriate valuation method, the treatment of goodwill, and whether discounts for lack of marketability or control should apply. In family-owned enterprises, additional complications can arise when ownership interests are intertwined across multiple generations or governed by shareholder or operating agreements. A precise valuation is essential to ensuring that the buyout amount accurately reflects the community interest without unfairly burdening the spouse retaining the business.

Structuring Family Business Buyouts in DivorceOnce the value is established, the buyout structure becomes critical. In some cases, the buyout may be funded with a lump-sum payment from liquid assets or through financing. In others, installment payments over time may be necessary to preserve cash flow and maintain business stability. Texas courts have broad discretion in approving buyout structures, but they remain mindful of enforceability and the receiving spouse's financial security.

Courts may also approve creative solutions, such as offsetting the buyout amount against other community assets, including real estate or retirement accounts. When structuring family business buyouts in divorce, careful attention must be paid to security for future payments and contingencies in the event of default. A well-drafted buyout arrangement can prevent post-divorce disputes and protect both parties from avoidable risk.

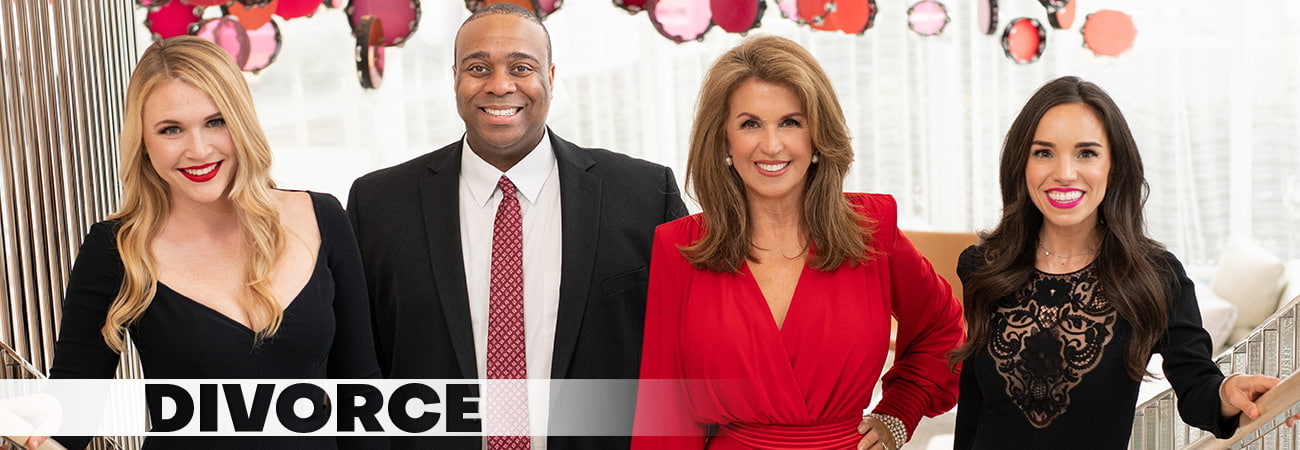

Consult an Experienced Dallas Divorce Attorney TodaySuccessfully navigating family business buyouts in divorce requires both experience and discretion. Whether you are seeking to retain ownership of a family enterprise or to secure fair compensation for your interest, it is advisable to consult an attorney. At McClure Law Group, our experienced Dallas divorce attorneys regularly represent business owners and their spouses in complex, high-asset divorces, and if you engage our services, we will fight for the results you deserve. Our main office is located in Dallas, and we have a Collin County office in Plano, where we meet clients by appointment. We represent individuals throughout Dallas, Collin, Denton, Tarrant, Rockwall, and surrounding counties. You can contact us at 214.692.8200 or complete our online form to schedule a confidential consultation.

McClure Law Group Home

McClure Law Group Home