Divorce Involving Donor-Advised Funds and Charitable Commitments

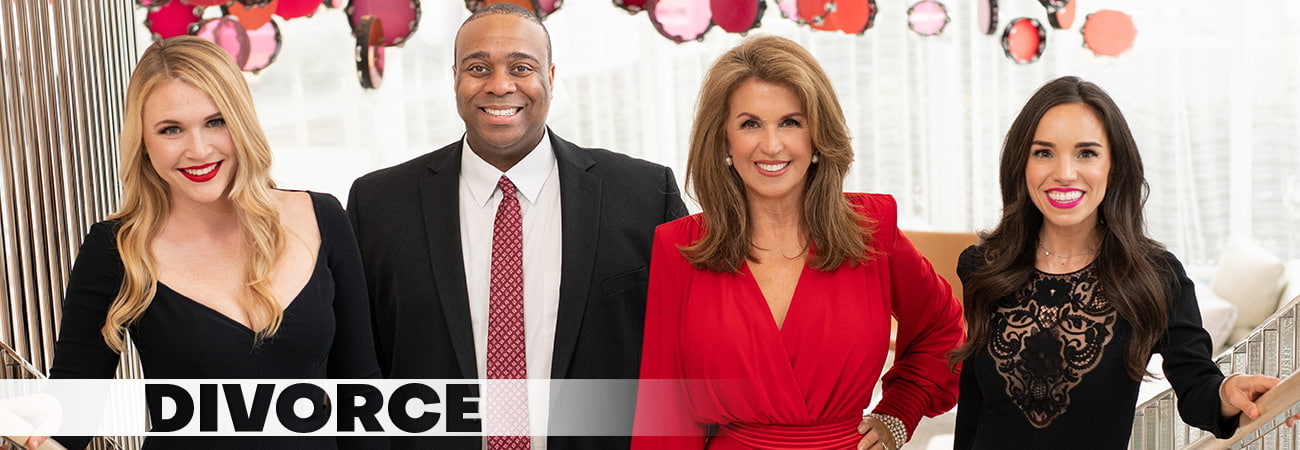

Navigating a divorce involving donor-advised funds and charitable commitments typically involves balancing generosity, financial planning, and marital property rights. What may have begun as a shared vision for charitable impact can raise difficult questions when spouses disagree about past contributions or future philanthropic intentions. Texas law requires courts to divide community property in a fair and just manner, but determining how charitable giving fits into that framework can be difficult. As such, when donor-advised funds, long-term pledges, and advisory privileges shape a couple’s financial landscape, it becomes critical to understand how these arrangements are evaluated in a Texas divorce. If you need assistance understanding your rights with regard to divorce involving donor-advised funds and charitable commitments, it is wise to contact an attorney. At McClure Law Group, our knowledgeable Dallas divorce attorneys possess the skills and resources to help you protect your financial interests as you dissolve your marriage, and if you hire us, we will advocate aggressively on your behalf.

Characterization and Treatment of Donor-Advised Funds Under Texas LawDivorce involving donor-advised funds and charitable commitments presents unique questions about asset characterization under the Texas Family Code. Although donor-advised funds are established using contributions from individuals, the assets placed into these accounts belong to the sponsoring charity, not the donor. This distinction means the fund itself is typically not considered divisible community property. However, the analysis does not end there. Courts often assess the source and timing of contributions, especially where substantial community funds were directed to charitable giving during the marriage. If one spouse asserts that contributions were made unilaterally or without mutual agreement, the court may evaluate whether those donations effectively reduced the marital estate. Because Texas courts aim to reach a “just and right” division, they may offset inequitable charitable transfers by adjusting the remaining community-property allocation.

Charitable Pledges and Ongoing Donation Obligations During DivorceIn some cases, courts handling divorce involving donor-advised funds and charitable commitments must address legally binding pledges or recurring donation obligations during property division. Not all charitable promises constitute enforceable debts, but some pledges may create obligations that need to be examined during a divorce. Courts will evaluate whether a pledge was incurred for the benefit of the marital community or whether one spouse acted independently. If the commitment served a joint purpose, such as supporting a shared philanthropic mission, enhancing business goodwill, or participating in community leadership, it may be treated as a community liability. If, however, a spouse made a substantial pledge without the other’s knowledge or consent, the court may determine that the responsibility is separate. Additionally, established patterns of charitable giving may influence a court’s assessment of spousal maintenance needs or overall financial expectations. In every scenario, careful documentation and legal analysis can help ensure that charitable obligations are accounted for in a balanced and informed manner.

Discovery, Transparency, and Protecting the Marital EstateWhen donor-advised funds are part of a couple’s financial picture, full transparency becomes especially important. Advisory privileges, although not ownership rights, can still affect the financial dynamics of a divorce. For example, one spouse may accelerate contributions to a donor-advised fund or recommend distributions shortly before filing for divorce. While these actions do not alter legal ownership, they may influence the size of the marital estate. Courts can consider whether such decisions were made in good faith or were intended to shield assets under the guise of generosity. Through discovery, a spouse may request detailed financial records, contribution histories, and communications with the fund’s sponsoring charity to evaluate the intent and impact of charitable transfers. If the evidence indicates misuse of community resources, courts may correct the imbalance through a disproportionate property division.

Speak With a Knowledgeable Dallas Divorce Lawyer About Charitable-Related Asset IssuesDivorce involving donor-advised funds and charitable commitments requires strategic advocacy to protect marital assets while honoring legitimate philanthropic intentions developed during the marriage. The knowledgeable Dallas divorce attorneys at McClure Law Group bring extensive experience to complex property division matters and provide tailored guidance to clients dealing with complex financial issues in divorce. If they represent you, they can aid you in navigating a divorce involving donor-advised funds and charitable commitments. Our main office is in Dallas, with a Collin County meeting location in Plano, and we represent clients throughout Dallas, Fort Worth, Rockwall, Frisco, McKinney, Irving, Richardson, and Garland. We also assist with family-law matters in communities across Dallas, Collin, Denton, Rockwall, Tarrant, and Grayson Counties. You can reach us by calling 214.692.8200 or by submitting our online form to schedule a confidential consultation.

McClure Law Group Home

McClure Law Group Home