Divorce

Although couples certainly don’t enter marriage anticipating a divorce, it is increasingly common: 50 percent of first marriages, 67 percent of second, and 74 percent of third marriages end in divorce. (Source: Forest Institute of Professional Psychology.) When your fortune and family matter, it is critical to be prepared, and to protect your interests with a highly competent Dallas divorce lawyer on your side.

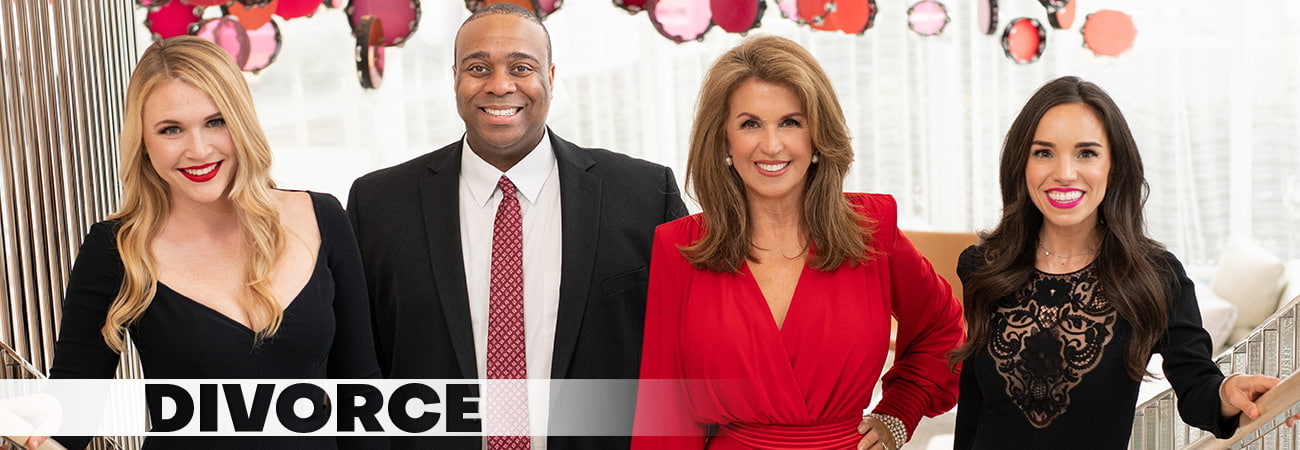

The McClure Law Group divorce attorneys’ high-energy, tough, no-nonsense demeanor and dynamic presence make each of them powerful litigators. The team of attorneys at the McClure Law Group aim to deliver maximum results utilizing their experience in tax law, complex financial and property matters, litigation, international divorce and family legal matters. We have decades of experience identifying and building a compelling case to protect every conceivable resource and asset, including:

- Assets owned in more than one state or country

- Convoluted income streams from numerous sources, including stock options, performance incentive payments, bonuses and award trips, royalties, and capital gains

- Valuation of personal and business real estate property, businesses, and other assets

- Equitable division of tax-deferred retirement accounts: IRAs, 401(k) plans, and pensions

- Equitable division of stock options and restricted stock

- Division of patents, copyrights, and other intellectual property

- The valuation of businesses

- Division of outstanding debts

- Treatment of trusts

- Parenting and custody plans

In any divorce, especially those involving estates of considerable size, the division of property is complex and vital to the protection of a client's fortune and family. McClure Law Group's Dallas divorce attorneys understand these complexities and utilize forensic accountants and business valuation experts to determine the real value and character of a client's assets. Any assets acquired during a marriage may be eligible for equitable distribution.

Asset TracingOften, assets may have been hidden by a spouse prior to a divorce. These assets must be discovered for a fair and equitable division of property during the divorce. Hiding assets is not just for the wealthy or business owners, anyone may have a rainy-day account that is not included in divorce documents. At McClure Law Group, sophisticated asset tracing is a critical step to ensure the transparency of the divorce and the financial stability of the client and children involved.

Spousal SupportSpousal support is another delicate matter related to divorce. Texas law allows two types of spousal support: contractual spousal support based on a contract between the divorcing spouses, or court-ordered spousal maintenance that is generally limited to a period of three years and caps the amount that can be ordered, except in the case of disability.

In 1995, the Texas Legislature enacted an alimony statute. However, the statute is quite restrictive, making court-ordered spousal support difficult to procure. Under the Texas Family Code, spousal support is intended to assist a divorced spouse who was out of the job market for many years, lacks job skills, and does not have enough assets to provide for their own reasonable minimum needs.

The statute states that spousal support is not justified unless the partner seeking alimony demonstrates that he or she attempted to seek suitable employment or to develop the necessary skills to support themselves during the separation period.

In addition, if a spouse has no skills or assets and has been married for at least 10 years, a spouse may be entitled to spousal support for a period of up to three years, and up to a maximum of $2,500 per month or 20 percent of the former spouse's average monthly gross income.

Whether there is a law in place or not, divorcing parties can and often agree to pay contractual spousal support. Under the Internal Revenue Code, spousal support payments are a deduction from the gross income of the payor and reportable gross income to the receiving spouse.

While working to protect your fortune and family, McClure Law Group strives to minimize the potentially negative impact divorce can have on children and relationships. Kelly McClure and the team of attorneys at the McClure Law Group offer clients the option of a collaborative approach to divorce, which allows parties to maintain discretion and reduce the financial and emotional burdens associated with family law litigation.

- 60 Day Divorces in Texas

- Abandonment and Divorce

- Acceptance of Benefits

- Addressing Intellectual Property Created During the Marriage

- Adultery and Divorce

- Agreements Incident to Divorce

- Annulment

- Attorneys’ Fees in Child Custody Cases

- Attorney’s Fees in Texas Divorces

- Bill of Review in Family Law Cases

- Breached Settlement

- Business Assets and Divorce

- Business Valuation in Divorce

- Causes of Divorce

- Characterizing and Tracing Property in Texas Divorces

- Collaborative Divorce

- Common Clauses in Prenuptial Agreements

- Community Property

- Compensation in Divorce

- Complex Asset Valuation in High Net Worth Divorce Cases

- Complex Marital Estates

- Complex Property Division

- Conflicting evidence in termination proceedings

- Contested Divorce

- Cost of a Divorce

- Cruelty as Grounds for Divorce

- Cryptocurrency and Digital Assets in Divorce Settlements

- Cryptocurrency and Divorce

- Debt Division in Divorce

- Default Divorce

- Defenses to Fault-Based Divorce

- Digital Currency and Divorce

- Discovery in Divorce Actions

- Discretion in Divorce Cases

- Dividing Investment Accounts and Bank Accounts in Divorce

- Dividing IRAs, 401Ks, and Pensions in Divorce

- Dividing Luxury Goods, Art, and Collectibles in High-Net-Worth Divorces

- Dividing Overseas Property in Divorce

- Dividing Real Estate in Divorce

- Division of Businesses in High Net Worth Divorce

- Division of Investment Portfolios and Securities in Divorce

- Division of Military Retirement in Texas Divorces

- Division of Retirement Funds in Divorce

- Divorce and the Marital Home

- Dividing Interests in Family Businesses During Divorce

- Dividing Stocks

- Divorce During Pregnancy

- Divorce for Business Owners and Executives

- Divorce for Doctors

- Divorce for Lawyers

- Divorce for CEOs, Executives, and Entrepreneurs

- Divorce for Professional Athletes

- Divorce for Real-Estate Investors

- Divorce for Tech Professionals: Equity, Stock Options, and RSUs

- Divorce Involving Business Partners

- Divorce in the Tech Industry

- Divorce Through Mediation

- Divorce with special needs children

- Domestic Violence and Divorce

- Domestic Violence and Spousal Support

- Do’s and Don’ts of Divorce

- Egregious Conduct and Equitable Distribution in Divorce

- Embryos in Divorce Actions

- Enforcement of Foreign Prenuptial Agreements in International Divorces

- Enforcing Divorce Decrees

- Evidence in Fault Divorce Cases

- Evidence in High Net Worth Divorce Cases

- Expert Testimony in Divorce Actions

- Fault Divorce

- Financial Disclosures in Divorces

- Foreign Divorce Judgments

- Forensic Accounting in Divorce: Identifying Hidden Assets

- Forensic Accounting Strategies for Complex Business and Medical Practice Valuations

- Fraudulent Transfers of Assets to Third Parties

- Hearsay Exceptions

- Hidden Assets

- High Net Worth Divorce

- How Death Impacts Divorce Actions

- How Inheritance is Handled in Divorce

- How Divorce Impacts Primary Breadwinners

- How Social Media Can Impact Your Divorce Case

- How to Protect Your Assets Before Filing for Divorce

- Impact of Premarital Cohabitation in Divorce Actions

- Informal-Marriage Divorce

- Inheritances and Child Support

- Inheritances and Divorce

- Insurance Plans in Divorce

- Intellectual Property in Divorce

- International Divorce

- Interspousal Gifts

- Jointly Titled Personal Property

- Jury trials in Texas divorces

- Just and Right Standard of Property Division

- Late Life Divorce

- Marital Assets

- Marital Debts After Divorce

- Mediated Settlement Agreements

- Military Divorce

- Mixed Property in Divorce

- Modification of Divorce Decrees

- Modification of Spousal Maintenance

- Modifying Marital-Property Agreements

- Motions in Divorce Actions

- Offshore Accounts and International Assets in Divorce

- Oil and Mineral Rights in Divorce

- Partition or Exchange Agreements

- Phantom Income in Divorce

- Preparing for Your Divorce Mediation

- Process of Filing for Divorce

- Property Division / Property Distribution

- Property-Division Appeals

- Property Settlements

- Protecting Business Partnerships from Divorce Disputes

- Protecting Separate Property

- Proving a Marital-Property Agreement Should Be Enforced

- Rehabilitative Spousal Maintenance

- Same-Sex Divorce

- Separate Property vs. Community Property

- Separation Agreements

- Social Media and Divorce

- Social Security in Divorce

- Spousal Maintenance

- Spousal maintenance for a disabled spouse

- Spousal Maintenance in Same-Sex Divorce

- Spousal Support Violations

- Student Loan Debt in Divorce

- Tax Planning in Divorce

- Termination of Spousal Maintenance

- Texas Divorce Myths

- Timing of Divorce

- Trials in Divorce Cases

- Trust Assets in Texas Divorces

- Trusts in Divorce

- Uncontested Divorce

- Understanding Prenuptial and Postnuptial Agreements

- Understanding Spousal Maintenance in High-Asset Divorces

- Undisclosed Assets After Divorce

- Use of Industry-Specific Appraisers in Divorce Actions

- Valuation and Division of Medical Practices in Divorce

- Valuation and Division of Non-Fungible Tokens and Other Digital Collectibles

- Valuing Contracts and Endorsements in Divorces Involving Professional Athletes

- Valuing Law Firms in Divorce

- Valuing Medical Practices in Divorce

- Void Marriage

- What Happens to Retirement Accounts in a Divorce?

- What to Expect During the Divorce Process

- What to Expect in a High-Net-Worth Divorce

- Wiretapping

- Divorce Settlement Negotiation Strategies

- Family Office and Wealth Management Considerations in Divorce

- Spousal Support for High-Income Earners: How Alimony is Determined

- Divorce and Business Succession Planning

- Divorce Planning for Business Executives

- Divorce and Private Equity Interest

- Divorce and Closely Held Corporations

- Dividing Deferred Compensation Plans in Divorce

- Confidential Divorce Proceedings for High-Profile Clients

- Asset Tracing in Divorce

- Legal Considerations for Divorcing Couples with Significant Real Estate Holdings

- Evaluating Lifestyle and Spending Patterns in Spousal Support Cases

- Divorce and Art, Antiques, and Collectibles

- Divorce and Ownership in Limited Liability Companies (LLCs)

- Handling Loans, Debts, and Liabilities in High-Asset Divorces

- Navigating Divorce When One Spouse Is a Silent Investor or Beneficiary

- Business Records and Divorce: What Must Be Disclosed

- Divorce For Families With Multi-Generational Businesses

- Divorce Involving Donor-Advised Funds and Charitable Commitments

- Managing a Divorce Involving Inherited Wealth

- Business Records in Divorce

- Divorce Involving Deferred Bonuses

- Divorce When a Spouse Is a General Partner

- Managing Divorce With Multistate Property

- Valuing Real Estate Holding Companies in Divorce

- Family Business Buyouts in Divorce

- Asset Freezing Orders in Divorce

McClure Law Group Home

McClure Law Group Home